The Monetary Transmission Channel Describes How the Fed Uses Its

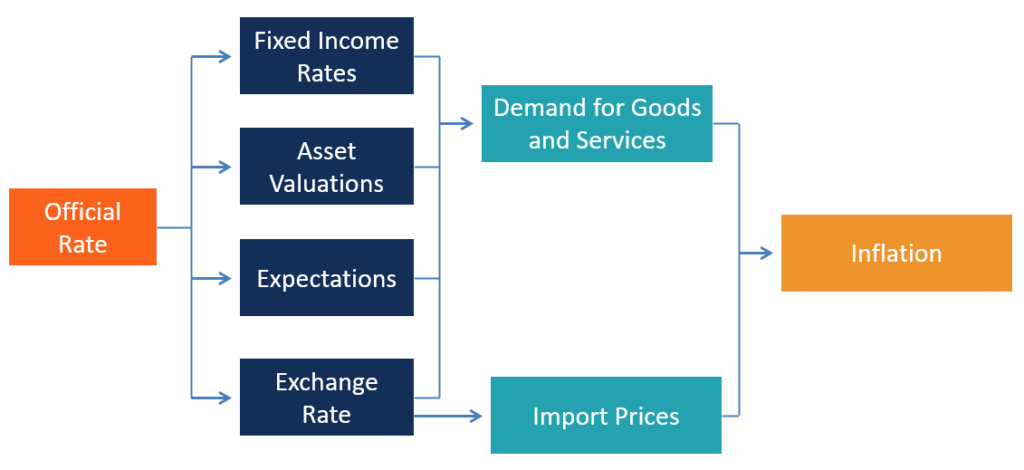

The core channels of policy transmission - the neoclassical links between short-term policy interest rates other asset prices such as long-term interest rates equity prices and the exchange rate. We discuss the evolution in macroeconomic thought on the monetary policy transmission mechanism and present related empirical evidence.

The Big Longs Of The Big Short Hero The Big Short Michael Burry Company Values

Use of these tools also resulted in a substantial portion of the Feds balance sheet consisting of private credit.

. Monetary policy was transmitted to private financial markets. On average each day US. Before the financial crisis reserve balances were roughly 20 billion whereas the level has risen well past 1 trillion.

Contractionary monetary policy reduces stock prices which reduce the value of financial assets and increase the probability of household financial distress. Expansionary monetary policy increases stock prices and thus the net worth of firms. Now that you know about the Feds tools lets see how the Fed uses the tools to achieve its dual mandatemaximum employment and price stability.

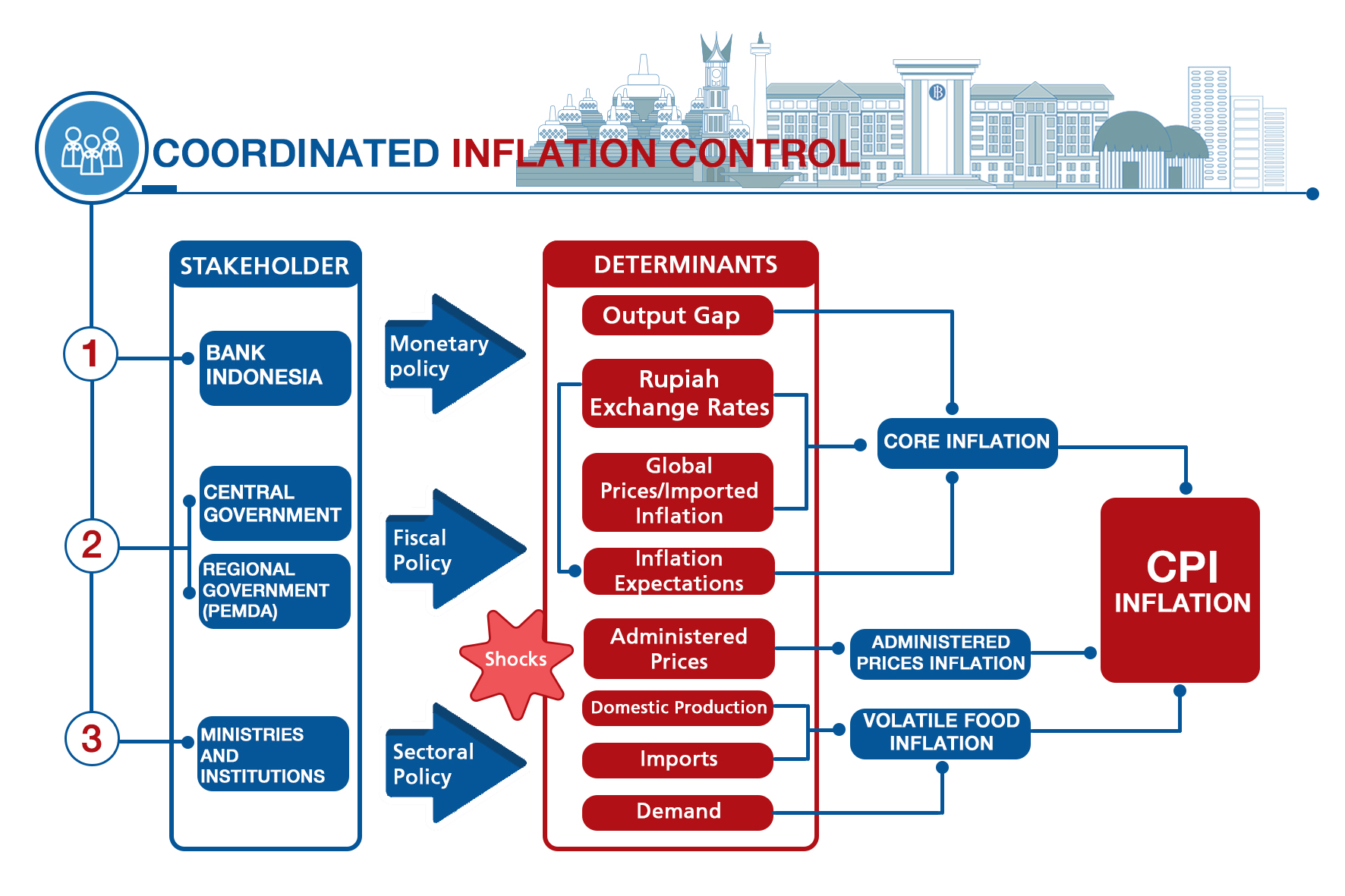

Channel Monetarist channel πe A Monetary Transmission Schema Monetary transmission is a complex and interesting topic because there is not one but many channels through which monetary policy operates. The best-known channels specified by Mishkin 1995 are the interest rate credit asset price and exchange rate channels. The monetary transmission mechanism in the.

Specific channels of monetary transmission operate through the effects that monetary policy has on interest rates exchange rates equity and real estate. Some answers and further questions Kenneth N Kuttner and Patricia C Mosser1 Federal Reserve Bank of New York Introduction What are the mechanisms through which Federal Reserve policy affects the economy. Focusing on the balance sheet channel and using bank.

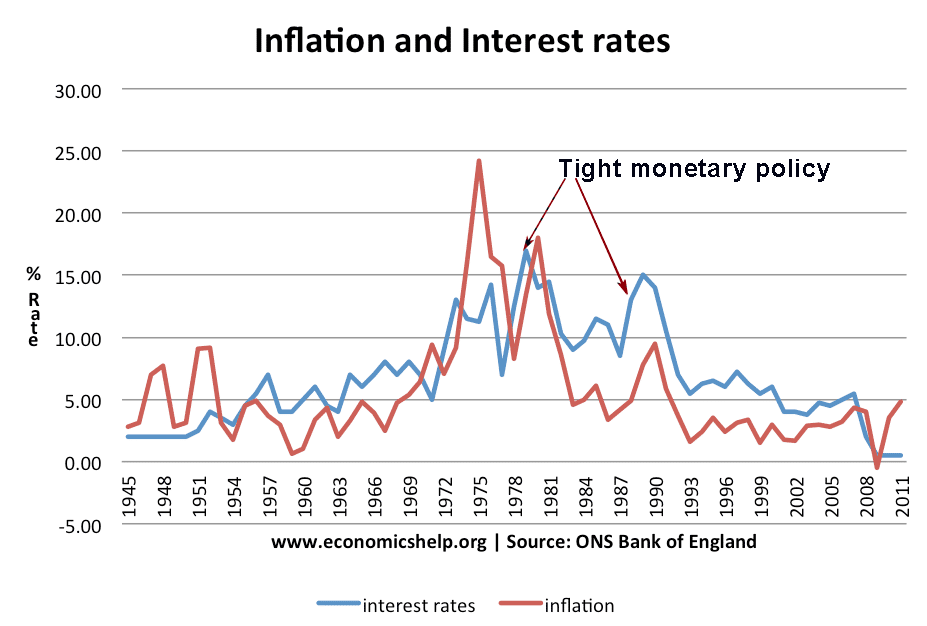

This finding is different in spirit from the widely-found negative relationship between financial development and the strength of the lending channel of monetary transmission. Interest rate channel may also be at work in the transmission of monetary policy. TF changing nominal interest rates changes real interest rates in the short run because inflation changes little in the short run.

The Federal Reserve can make use of a monetary policy to create or print more money allowing them to purchase government bonds from banks and resulting to increased monetary base and cash reserves in banks. The exhibit depicts schematically an eclectic view of monetary policy transmission identifying the major channels that have been. Decisions affect economic growth prices and other aspects of the economy.

This paper shows that the balance sheet channel of monetary transmission is stronger for US banks that securitize their assets. The transmission of monetary policy describes how changes made by the Reserve Bank to its monetary policy settings flow through to economic activity and inflation. This statement describes what monetary transmission channel.

Monetary Transmission Channels IIImplementing Monetary PolicyI IV. Asymmetric information on lending and balance sheets. The monetary policy toolkit in the 1920s is particularly interesting because the Federal Reserve had three policy instruments at its disposal each of which affected financial conditions through a slightly different channel.

It boosts economic growth. Theories of Monetary Transmission Mechanisms II. Monetary Transmission Mechanism in a Small Open Economy.

Therefore its monetary policy achieved through to the use of its main instrument namely the fed funds rate. TF most economists think the fed should target output in the long run and price stability in the short run. The interest rate channel of monetary policy exists if monetary policy actions affect interest rates that cause indi-viduals and businesses to alter their spending decisions that in turn bring about changes in output and prices.

Expansionary monetary policy is when a central bank uses its tools to stimulate the economy. 5 To explain how such changes affect the economy it is first necessary to describe the federal funds rate and explain how it helps determine the cost of short-term credit. The literature on monetary policy describes various transmission channels.

This process is complex and there is a large degree of uncertainty about the timing and size of the impact on the economy. Monetary policy transmission mechanismthe interest rate channel of monetary policy. It lowers the value of the currency thereby decreasing the exchange rate.

Expansionary Monetary Policy Using the Feds Tools. Traditionally most work on monetary policy transmission in the 1920s has focused on the reserves channelthat is how the Feds actions affected the supply and cost of. As net worth rises adverse selection and moral hazard are reduced and this bank lending increases which increases investment.

The credit market channel of monetary transmission acts primarily through the effect of. This also means lower interest rates and eventually more money for financial. Monetary transmission mechanism money multiplier lending channel With the use of nontraditional policy tools the level of reserve balances has risen significantly in the United States since 2007.

A Bayesian Structural VAR Approach Rokon Bhuiyan August 15 2008 Abstract This paper develops an open-economy Bayesian structural VAR model for Canada in order to estimate the effects of monetary policy shocks using the overnight target rate as the policy instrument. Any reuse requires the permission of the STI. That increases the money supply lowers interest rates and increases demand.

It allows for the imposition of quantitative easing by the Central Bank. How and by which channels monetary policy affects the economy overall is called the monetary transmission mechanism MTM. The monetary transmission mechanism describes how policy-induced changes in the nominal money stock or the short-term nominal interest rate impact real variables such as aggregate output and employment.

The Fed describes the transmission mechanism of monetary policy as originating from its dual mandate ie maximum employment low and stable inflation. The monetary transmission mechanism refers to the process through which monetary policy. Monetary Policy Monetary policy is an economic policy that manages the size and growth rate of the money supply in an economy.

It is the opposite of contractionary monetary policy. TF quantitive easing is essentially expansionary monetary policy. Suppose the economy weakens and employment falls short of the Feds maximum employment goal.

1 Monetary policy then acts to influence aggregate demand via its impact on good prices asset. Summary This training material is the property of the IMF Singapore Regional Training Institute STI and is intended for the use in S TI courses. The federal funds rate The FOMCs primary means of adjusting the stance of monetary policy is by changing its target for the federal funds rate.

It is a powerful tool to.

Pdf The Effect Of The Monetary Base On Money Supply Does The Quantity Of Central Bank Money Carry Any Information

Cap Structure Sme Eu Png Finance Bank Basel Iii Sba Loans

Eurusd Pull Up Banner Design New Things To Learn Cool Gadgets To Buy

Monetary Transmission Mechanism Overview Central Bank Action

Brazil Central Bank Hastens Rate Hikes To Strangle Inflation Usd Brl In Peril Central Bank Exit Strategy Bank

Have An Extra 1 000 In Your Savings Account Here Are 3 Ideas Money Quiz Lessons Learned Financial

Chapter 11 Monetary Transmission Effectiveness And Policy Implications In Paving The Way To Sustained Growth And Prosperity In Central America Panama And The Dominican Republic

Tight Monetary Policy Economics Help

Tight Monetary Policy Economics Help

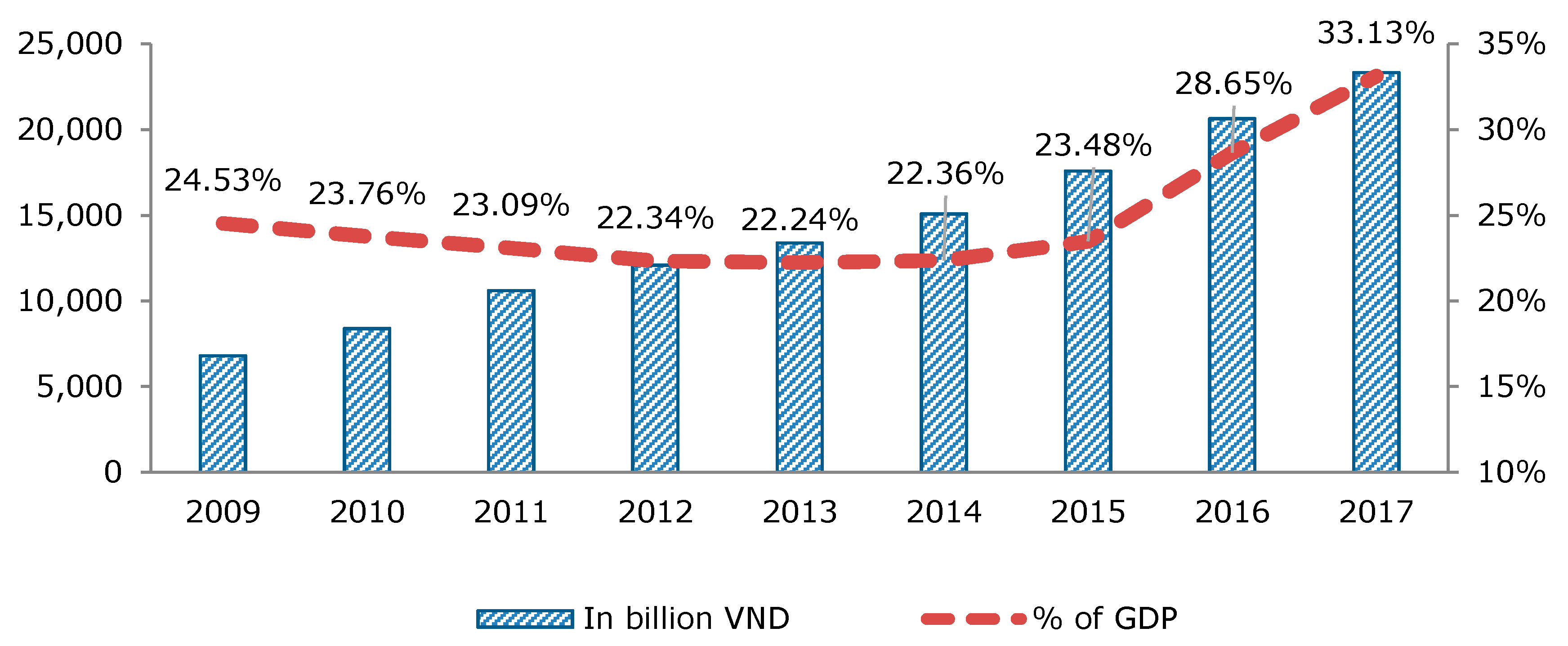

Economies Free Full Text Impact Of Monetary Policy On Private Investment Evidence From Vietnam S Provincial Data Html

Trading Reviews Company Provide Fully Automated Real Time Top Trading Software Reviews Entrepreneuriat Comment Creer Son Entreprise Creation Micro Entreprise

Chapter 11 Monetary Transmission Effectiveness And Policy Implications In Paving The Way To Sustained Growth And Prosperity In Central America Panama And The Dominican Republic

How Quantitative Easing Works Infographic Via Wsjgraphics Infographic Corporate Bonds Online Forex Trading

Comments

Post a Comment